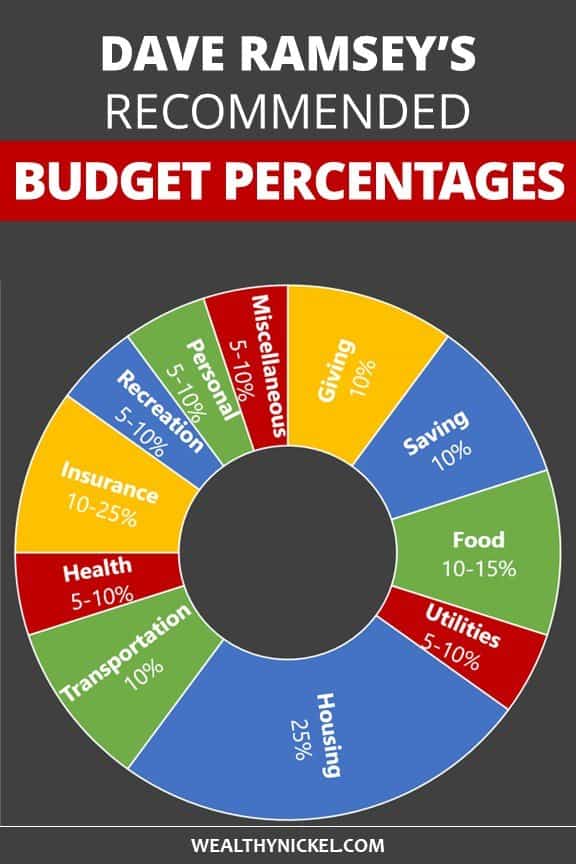

Insurance: For Ramsey, the four essential types of insurance you want to budget for are health, home, auto and term life. If you have any leftover funds in the miscellaneous category, you can put them toward your financial goals. Miscellaneous: This category should be around 5% of your take-home pay and can be used for non-emergency expenses during the month, such as a gift for a family or friend. If you choose not to tithe at this rate, you can reallocate the 10% elsewhere in your budget. Giving: Ramsey recommends tithing 10% of your take-home pay to your church, charities or worthy causes, even if you’re in debt. Babysitting expenses for one-off occasions like date nights should be budgeted within the entertainment category instead. He suggests $267 – $315 for singles, $640 for couples, and $928 to $1,109 for a family of four (noting that these numbers can vary based on dietary restrictions and lifestyle choices).Ĭhildcare: According to Ramsey, Childcare expenses - which can range from $10,700 to $15,900 per year per child - should be budgeted in an additional and dedicated category to cover the costs of parents being able to work. Bureau of Labor Statistics to help determine your desired budgeting percentages for groceries. Note that if you’re in debt-payoff mode, Ramsey says you should save as much as you can - even if that figure exceeds 15%.įood: Ramsey suggests using the following national averages from the U.S. Once you’ve saved a three-month emergency fund, you can start saving for retirement and other bigger purchases. But depending on where you’re at in Ramsey’s baby steps framework, your savings might be going towards building your emergency fund or your debt snowball (paying off non-mortgage debt). Saving: The end goal is to save 15% of your gross income for retirement. For homeowners, Ramsey suggests a 15-year fixed mortgage with 10% to 20% down. This figure is the same whether you’re renting or paying on a mortgage.

Housing: Ramsey uses a strict percentage limit here, stating that your total housing payment shouldn’t exceed 25% of your take-home pay.

#Dave ramsey recommended percentages how to

While he has more information on his site about determining your own ideal budgeting percentages, here’s a breakdown of how to approach each category. Of course, your circumstances may vary from this example, which is why you shouldn’t follow Ramsey’s recommendations blindly. Here are Ramsey’s ideal percentages across his 12 budget categories, using the example of a family of four with take-home pay of $6,000 per month who needs part-time childcare, has employer-paid health insurance, and has paid off their non-mortgage debt:ĭave Ramsey’s Budget Categories Explained In other words, there’s no one size fits all budget.īut that doesn’t mean you can’t learn from his general guidelines. Additionally, his recommended budgeting percentages differ based on factors such as the size of your household, whether you need childcare, where you are in the baby steps process and other variables. Ramsey uses a combination of income percentages and set figures drawn from national income averages to determine his recommendations.

Dave Ramsey’s Household Budget Percentages: Summary & Final Thoughtsĭave Ramsey’s Recommended Household Budget Percentages.Dave Ramsey’s Recommended Budgeting System.How to Analyze Your Monthly Budget (and Create One That Works).Dave Ramsey’s Household Budget Percentages Analyzed.Dave Ramsey’s Budget Categories Explained.

0 kommentar(er)

0 kommentar(er)